BELOIT, Wis. — In our Two Americas series, we show you areas of Southeast Wisconsin you may not see every day, but might relate to the obstacles they face.

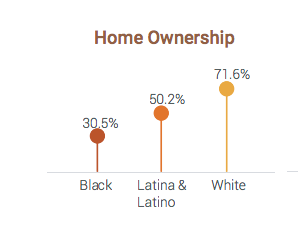

An eye-opening study on racial disparities was recently published in Beloit by YWCA Rock County. It sheds light on many issues, including why home ownership for Black residents is less than half the size of white home ownership.

The term "it takes a village" is poignant when searching for what needs to be done to address the racial disparities Black and Latino families are experiencing.

“We’re typically using information from Madison and Milwaukee and some of the larger cities, but this is specifically for Rock County,” said Amiee Leavy, YWCA Rock County.

Leavy says the published report studied inequalities in areas of our society that you may not think of right away.

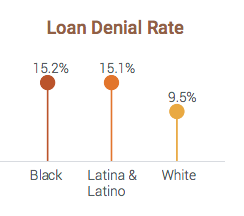

This also includes home denial rates, when broken down by race. In 2020, the home loan denial rate for Black and Latino applicants in Rock County was about 15 percent, compared to white applicants, which was 9.5 percent.

“What you also need to look at, coupled with that denial rate, is the number of applications being processed, so you can’t just look at the denial rate, but the pool at which they had to approve or deny,” said Leavy.

She says in total, 9,798 people who applied in Rock County identified as white, compared to 360 loan applications by Latinos, and just 138 total home loan applications for those identifying as Black.

“If we can accelerate that number, will that denial rate still remain lower than the state and if no, why? What are the implications for that,” Leavy questioned.

Francisca Reyna worked on YWCA Rock County’s Racial Justice Committee. For the past 20 years, she has worked to help minority home owners qualify for loans at Blackhawk Bank in Beloit.

“What I find in the Latino community is that they don’t have any credit whatsoever. In the African-American community, I find they have credit, but they need to repair their credit,” said Reyna.

Her free credit building education programs have changed the lives of families.

“Most of our clients that come to us, if they’re not ready, we'll get you ready in a year,” Reyna said.

Inequalities may start even before looking at an individual’s credit. Traditionally the rule of thumb is for the cost of your home to not exceed three times your salary.

However, data from 2020’s Wisconsin Realtor's Association shows the median home price in Wisconsin was $220,000. That is seven times higher than the median income among Black households statewide, nearly five times higher than the median income of Latino households, and more than four times higher than the median income of white households.

“It's also about wealth building and generational wealth and how that is passed on to your children and their children, which home ownership is a staple for most people,” Leavy added.

Showing more work for equality is crucial to the future of Rock County, and this study may be the starting point to eliminate these disparities statewide.

![SNG_Digital_Ad_480x360_CTA[13].jpg](https://ewscripps.brightspotcdn.com/7d/db/0b14063144e881c22c4592637e0d/sng-digital-ad-480x360-cta13.jpg)