MILWAUKEE — Women hold two-thirds of the $1.7 trillion outstanding student loan debt in the country, according to a report from the American Association of University Women (AAUW).

The report says that discrepancy is due in part to women taking out more to begin with and facing a pay gap after graduation. Ultimately, the disparity in student loans impacts women of color the most, especially Black women.

AAUW reports that on average white men take out $29,862 in student loans, white women take out $31,346, and Black women take out $37,558.

On top of that, women can expect 81% of what their male counterparts after graduation.

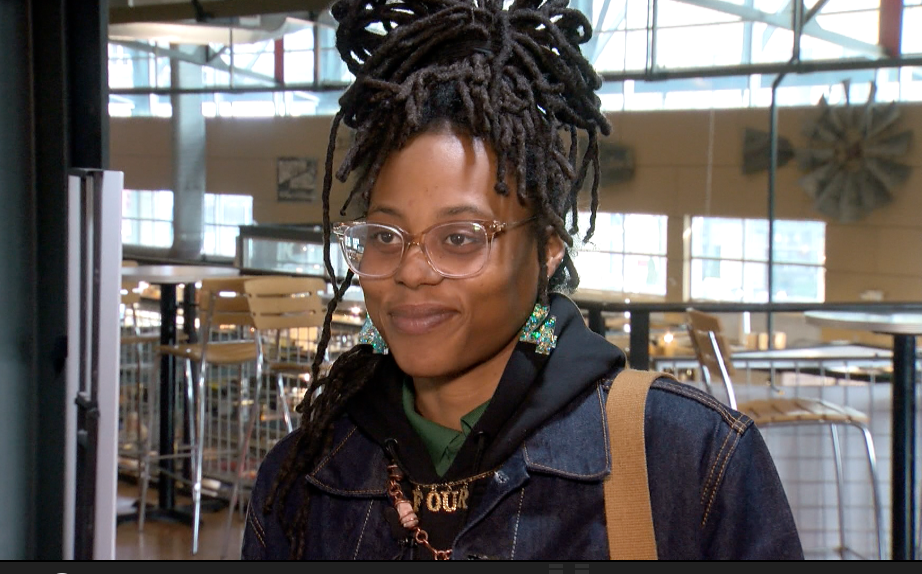

Milwaukee resident Radaya Ellis is one of the many Americans that took out loans to get her education. She said she did receive merit-based scholarships, but that wasn't enough to fully pay for tuition and living expenses.

"I mean my parents, if they did have the money, it wouldn't last. It would be like a one time thing, like I can pay for your books, but never full tuition," she said about the reason she took out loans.

She ended up taking out about $120,000 in loans for her undergraduate and graduate education. She graduated in 2016 and said the effects of that student debt are starting to catch up with her.

According to AAUW, "57% of Black female graduates report financial difficulties while repaying student loans."

"It's hitting me right now because I'm trying to buy a home. It's impacting my credit, it's perceived as a liability," Ellis said. "All of that is impacting the next life that I want to live. I don't want to rent for the rest of my life... It's like I now have this degree I have to work off instead of work towards the life I want to live, because of the degree."

Financial Advisor Erica Wright with Bell and Wright Financial Group said, "We've been taught that getting those student loans in the beginning is the way to go and you can make that up on the back end."

But she said that's really not the best way to go about taking out students loans.

"My rule of thumb is you should only be taking out the amount of student loans that you would be making in the first year salary after you graduate," Wright said.

However when loans are the only option, that may not be possible. If you end up finding yourself feeling like the debt will never get paid off, Wright recommends reaching out for help. She said what you don't want to do is stop paying them all together, because that can have severe impacts on your credit.

"We just figure out where you are right now and how you can build comfort for your situation," Wright said.

Since the pandemic began, there has also been increased talk about student loan forgiveness. One proposal suggested forgiving up to $50,000 per person.

"It will help, it will probably take a few years off the time frame in which I still have to pay back the loan," Ellis said.

But even then, she expects she has at least 10 more years of paying off her student debt.

The AAUW lists several things that would help the disparities women face when it comes to student loans. Some of those include:

- Protecting and expanding Pell Grants for low-income students.

- Increasing funding for public universities at the state and local level.

- Easier options for income-drive repayment options.