MILWAUKEE — If you are set to receive federal student loan forgiveness in Wisconsin, the Department of Revenue says be prepared to pay state income taxes on that relief.

Wisconsin is among a handful of states where the loan forgiveness will be treated as taxable income unless the state legislature acts to change that.

There’s no federal income tax for the student loan relief borrowers receive, but that isn’t the case at the state level in Wisconsin. A Milwaukee accountant says depending on how much you make and how much you’ll have forgiven, you could be paying hundreds to more than a thousand dollars in additional taxes when you file next spring.

Rachel Campbell says she had no idea she’d be taxed by the state on the $20,000 in debt that she’s getting wiped out.

“I’m not very pleased with that,” she said. “Let me start a clean slate.”

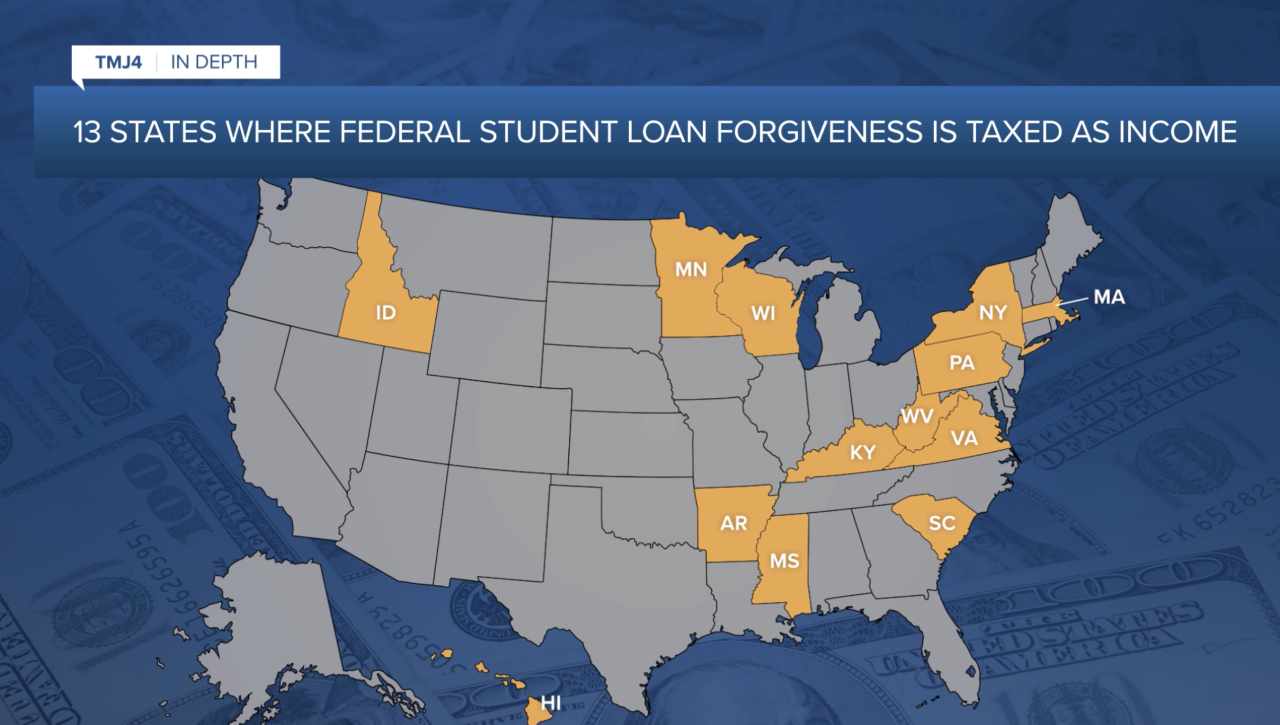

Dozens of other states either don’t have a state income tax or they have already conformed with the provisions of the American Rescue Plan Act that removed federal income tax from this student loan debt relief.

Tax accountant Jaquilla Ross says Wisconsin is one of the 13 states where the forgiveness is currently set to come with an income tax.

"If you're getting back the $10,000, you can expect to pay at least $530 and that's just the minimum for sure, but it's going to essentially depend on your income,” she said. "If you're forgiven for $20,000, you can expect essentially about a little bit over $1,100."

The state tax rate is 5.3% on individual income above $24,250 and for married taxpayers whose income is more than $32,330.

The Wisconsin Department of Revenue says the state legislature would have to rescind the tax to have it align with the federal government.

The department says it’s asking the legislature to adopt those changes. "It's advantageous to be in harmony with the IRS,” the department’s communications director said in an email.

It’s something Minnesota’s governor has called for and its legislature is already considering.

Since Republicans have majority control in the Wisconsin Legislature, TMJ4 went to State Representative Adam Neylon to see if it could happen here.

"I'm a Republican, but this might be the first tax break that I would oppose,” he said.

Rep. Neylon says he and fellow Republicans oppose this student loan relief in the first place.

"I think in this specific case when you're talking about relieving debt for people that willingly took and participated in, I think that this is almost a double benefit in some ways,” he said.

Borrowers we spoke with paying roughly 5 percent in taxes on what they get forgiven is still much better than paying the full amount.