MILWAUKEE — President Joe Biden says the federal student loan forgiveness application officially opened on Monday.

The U.S. Department of Education says 8 million people already applied for the relief during a beta test over the weekend.

The White House estimates 685,000 Wisconsinites are eligible for the broad federal student loan relief, but a UW-Madison professor who researches student loan programs says one lawsuit, in particular, could upend the forgiveness.

UW-Milwaukee student Olivia Ferguson says she couldn’t have been more excited two months ago when she learned she could get $10,000 worth of student loans wiped out before graduating college. Ferguson says that feeling of joy is now in contrast with worries that a lawsuit could prevail and the forgiveness may not happen.

"Some of that anxiety started to creep back in that it might not be as stable of an idea as we thought it was and just the fear that that really good idea could be overturned,” she said.

Several lawsuits seek to do just that as President Biden acknowledged during a news conference Monday.

“Litigation is underway,” he said. “Our legal judgment is that it won’t, but they’re trying to stop it.”

To date, five lawsuits have reportedly been filed in court. Two of which, including one in Wisconsin, have already been denied due to a lack of legal standing.

"To get standing, you have to prove that you're harmed by these actions and so to prove that you've been harmed by canceling a loan is a really hard needle to thread,” UW-Madison professor Nick Hillman explained.

Hillman says the lawsuits are attacking the forgiveness plan from all sorts of angles to clear the legal standing hurdle and more lawsuits are expected to come now that the application process is officially open.

Out of the three that are currently still awaiting a court decision, Hillman thinks the one filed jointly by six states has the best chance to undo the forgiveness.

"The big one that I think has the most credibility is the student loan servicers are the ones who are potentially directly harmed by these actions,” Hillman said.

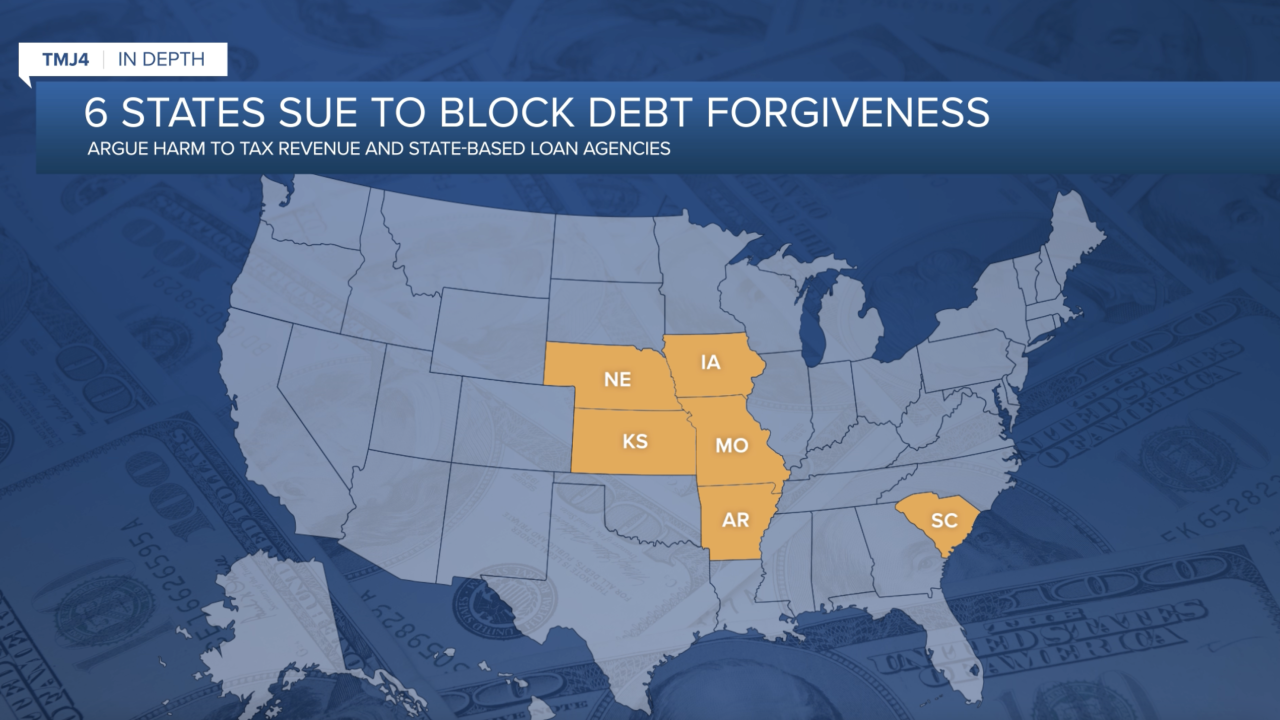

Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina argue the debt relief would harm loan servicers in their states and ultimately reduce tax revenue.

"If they are found to have standing and can proceed, I wouldn't be surprised if this goes all the way up to the Supreme Court and gets stopped before a single penny is canceled,” he said.

While Hillman believes broad student loan forgiveness is far from certain at this point, the president of a non-profit called The Institute of Student Loan Advisors argues the Biden administration scaled back eligibility for forgiveness in an attempt to ensure the lawsuits fail. For example, 770,000 borrowers are now excluded because their federal student loans are held by private lenders.

“I’m not going to say there's a zero percent chance of something legally getting in the way of the broad debt relief,” Betsy Mayotte said. “My gut tells me that the chances are pretty low that the entire program will be blocked, but as they say, one should never count their chickens until they're hatched.”

Although the forgiveness application is officially open, a court order means the Department of Education cannot begin discharging student loan debt until next Monday.